Alpha Dhabi reports strong growth innet profit of AED 7.3 billion

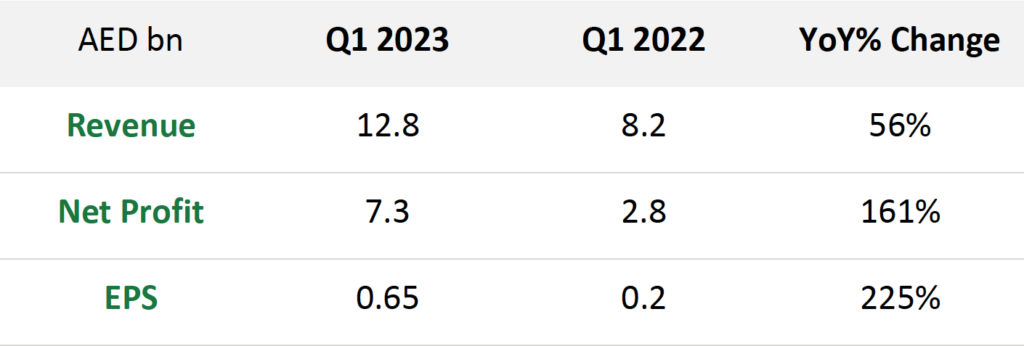

- Record three-month performance with net profit at AED 7.3 billion and revenue at AED 12.8 billion, up 161% and 56% respectively

- Demonstrates Alpha Dhabi’s continued success and accelerated momentum as it executes its growth and expansion strategy across its core verticals and diversified platform

FINANCIAL PERFORMANCE AND METRICS

Abu Dhabi, UAE; 05 May 2023: Alpha Dhabi Holding PJSC (“Alpha Dhabi” or “the Group”), one of the fastest-growing investment holding companies in the MENA region, listed on the Abu Dhabi Securities Exchange (ADX: AlphaDhabi), has announced its financial results for the three-month period ending 31 March 2023.

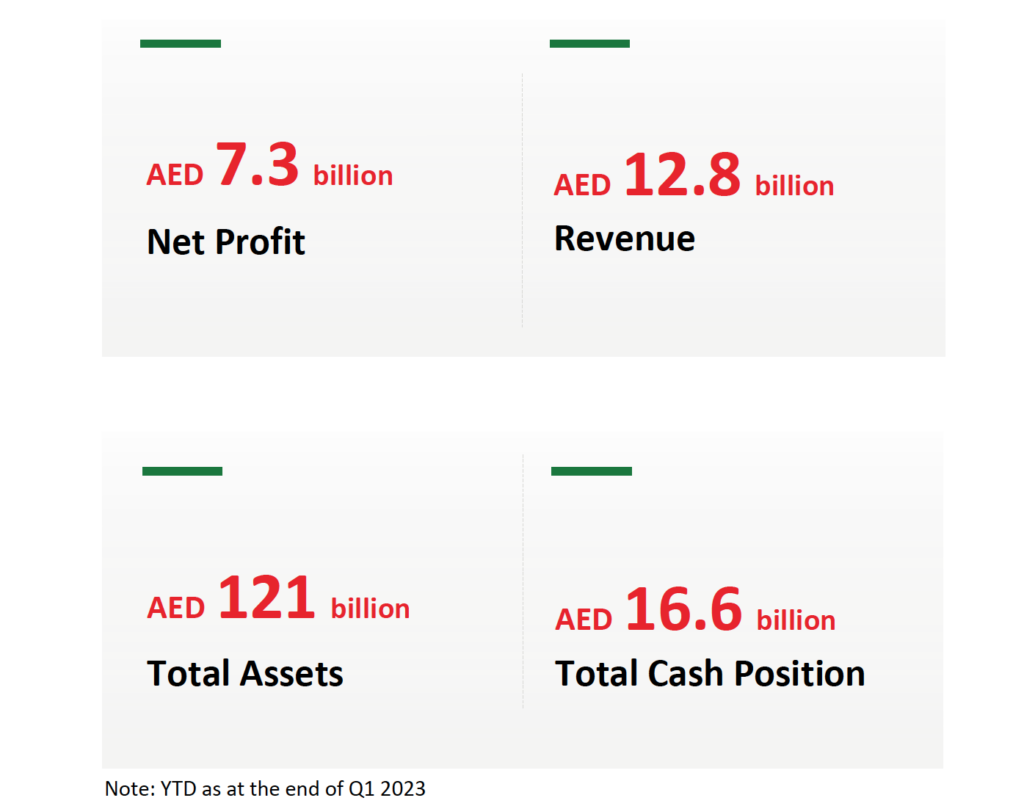

Alpha Dhabi reported a strong set of first quarter financial results with net profit up 161% year-on-year to AED 7.3 billion (Q1 2022: AED 2.8 billion), which includes a fair value gain as a result of the derecognition of Pure Health Holding LLC. Revenues also grew significantly to reach AED 12.8 billion, representing a 56% year-on-year increase (Q1 2022: AED 8.2 billion), with contributions from the existing real estate and industrial portfolio continuing to be strong drivers of growth for the Group.

Alpha Dhabi continues to pursue acquisitions and investments as part of Its growth strategy and announced a partnership with Mubadala to co-invest in global credit opportunities. Alpha Dhabi and Mubadala aim to collectively deploy up to ~AED 9 billion (approximately US $2.5 billion) over the next five years, leveraging Mubadala’s long-term and strategic partnership with Apollo (NYSE: APO), one of the world’s largest alternative asset managers, to access high-quality private credit investment opportunities. Mubadala will hold 80% ownership in the Abu Dhabi Global Market-based joint venture entity, with the remaining 20% to be held by Alpha Dhabi

This transaction also represents Alpha Dhabi's entry into the private credit market as it continues to execute on its diversification strategy and capitalise on investment opportunities in new markets. Alpha Dhabi's portfolio expansion outside of the UAE is supporting growth with overseas revenue accounting for AED 0.9 billion in the first three months of 2023, representing a 7% increase year-on-year. Alpha Dhabi’s balance sheet remains strong with AED 120.6 billion in total assets, representing a 129% increase year-on-year, on the back of strong investment activity. The Group remains well-funded with a strong cash position of AED 16.6 billion to support and drive growth and expansion across both sectors and geographies. Through our strong operating model, financial position, capital deployment track record and agile investment approach Alpha Dhabi remains uniquely positioned to continue to drive further growth and capitalise on investment opportunities while also generating value for shareholders in both the short and long term.